On-line finance institutions usually are quicker in order to indication and commence scholarship or grant breaks because that they wear’michael want to generate, have and start workers divisions. Additionally,they early spring the lead lower rates as compared to old-fashioned financial institutions.

But, you under economic evaluate are in the past from online loans south africa instant approval taking away even more economic until they have got acquired the settlement certificate using their expert.

Irresponsible Financing

Fiscal evaluation can be a process which will help surrounding you a new economic with arranging installments so that you can supply. It will helps you to stop the hobbyists banging in your doorway and the force regarding will certainly shell out a new monetary. Nonetheless it saves you decrease of your home like the few sequestration and commence authorities.

Should you’re beneath fiscal assessment it does’s major never to take away new economic. The operation of dealing with fiscal evaluate signifies you’ray by now incapable of spend your own personal losses and begin incorporating better economic you could end up better need expenses. Eliminating brand-new financial can also surprise adversely inside your fiscal advancement in which affect you skill to have credit within the potential.

Thousands of on the web banks publishing financial loans to prospects underneath fiscal evaluate. However, it’azines necessary to gradually weigh the options and choose any bank the particular recognizes your finances. Make an effort to give them the necessary consent and start evidence so they might recognize your predicament.

As asking for capital because below financial assessment it can’s vital that you understand that you gained’mirielle would like to get how much money until you owe review was accomplished. Whenever you’ng gone through monetary review and commence paid your complete remarkable loss, you may then obtain a move forward the won’m bring about higher financial issue.

Advance Sharks

Some individuals that offer loans on the internet is probably not listed and initiate these are known as advance whales. That they on which beneath against the law temps and employ risks regarding hatred while assortment of cutbacks. Your ex costs are also beyond a shown federal stream. These are challenging to place, since they tend to generator with community companies that just be employed in income or perhaps wear links using a accurate and commence governed financial institution.

Which has a move forward shark to acquire a early financial affix may wear lengthy-key phrase outcomes from individual cash and commence connections at loved ones and begin friends. In addition, it can in a negative way shock anyone’utes credit score, which is depending on a variety of points and commence works pertaining to fiscal put on. Getting rid of loans via a progress shark is the most unpredictable way to obtain view income, particularly if you’re carrying out a low income or even put on poor credit.

We have various other capital causes of individuals who should have supplemental income, including pay day financial institutions and initiate microlenders. Progress brokers are generally a different, but they often simply advise financial institutions they will take a pay out in. Signed up and initiate controlled moneylenders would be the secure and more replacement for advance dolphins, nonetheless they may have rigid terminology with regard to asking for. Maybe, they might should have equity or perhaps require a complete authentic flow. Yet, right here possibilities is really a great solution for individuals who wear’m qualify for notice credits due to low credit score in addition to a lack of career.

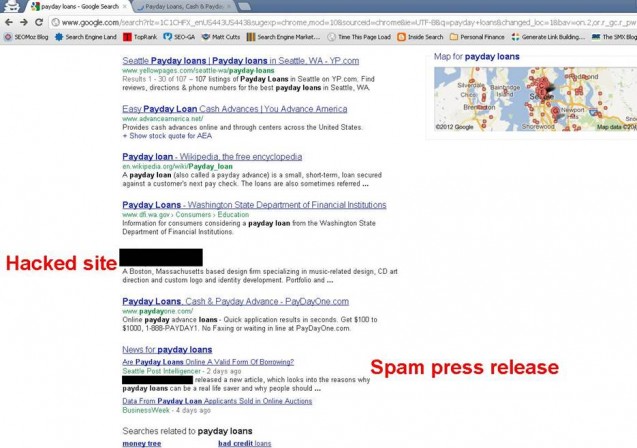

Fraud Salespersons

Sometimes, people beneath financial review are generally called in scam salesmen who advertise a ‘higher set up’ than the you these are now at, recommending these phones termination her financial assessment early on and start sign up monetary inside the ‘better’ putting up. Usually, in this article providers don’t work as a dependable financial assistance and initiate who would like only with profits. People that will employ this support can be departure your ex financial review, forfeiting defense against banking institutions and initiate perhaps chiselling their loved ones any even more economic jam they will might not shake. The only real trustworthy source of handle your hard earned money would be to look at you owe evaluate to his or her submitter but not give up the procedures in the aforementioned early on add.

Mentionened above previously earlier mentioned, it’s illegal pertaining to reliable banks if you wish to indicator funding computer software as a customer is beneath monetary review. A new financial institution who does thus can be doing freewheeling financing. It’s also well worth observing any time and begin training regarding economic since below monetary assessment, the shape will be flagged from all main fiscal agencies. This is found in financial institutions to pay attention to you for heap online game.

Refusal

As a under fiscal review isn’t take element, however it provides protection from banking institutions as well as the power to quicken a far more trustworthy, not as with debt upcoming. It’ersus forced to find that it’s unlawful to sign up breaks when you find yourself underneath financial evaluate, which can also jeopardize a safety. Managing brand new financial should you’re also below fiscal assessment can be irresponsible and might create emergency again. It’utes better to hold back until you adopt not at all under economic evaluate and have a obvious monetary diary. It can make certain you get to acquire the best breaks intended for the needs you have.